Carbon Pricing and the Economics of Green Ammonia

By Stephen H. Crolius on January 06, 2017

The United States Senate is expected to open confirmation hearings for Secretary of State nominee Rex Tillerson on January 11. Tillerson, newly retired from Exxon Mobil, became the chief executive officer of that company in 2006. He has attracted many labels since his nomination was announced, but “climate denier” is not among them. The climate-action NGO 350.org can only refer to him as a “top funder of climate denial and attacks on climate action” because the fact is that, Tillerson, consistent with Exxon Mobil’s corporate position, is an advocate of a carbon tax. “A carbon tax is . . . the most efficient means of reflecting the cost of carbon in all economic decisions — from investments made by companies to fuel their requirements to the product choices made by consumers,” he said in a speech in 2009.

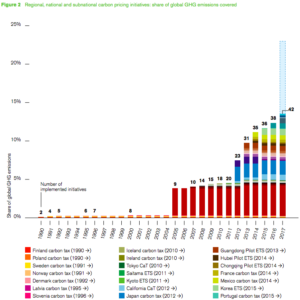

The elevation of a carbon-tax advocate to a leading position in the Trump administration occurs at an interesting moment for carbon-pricing schemes of all types. In October, with the release of “State and Trends of Carbon Pricing 2016”, the World Bank reported that carbon pricing is the subject of “growing momentum” around the world. “Carbon pricing initiatives will play an increasing role, with about 100 Parties — accounting for 58 percent of global GHG emissions — planning or considering these instruments,” the report states. It goes on to say that “Already, about 40 national jurisdictions and over 20 cities, states, and regions are putting a price on carbon. This translates to a total coverage of around 7 gigatons of carbon dioxide equivalent (GtCO2e) or about 13 percent of global GHG emissions.”

Many ammonia energy advocates believe that ammonia will not find its footing as an energy carrier until carbon pricing has truly taken hold in important markets. This may prove to be the case, but there is opinion – and investment – that is not waiting for this to happen.

The discussion of ammonia’s economics must focus on green ammonia. No one will make the investments needed to bring ammonia into the energy arena if it is simply one more commodity with a problematic carbon footprint. With that said, it is worth observing that if ammonia were in use as an energy carrier today, it would already be cost-competitive. Conventionally produced ammonia has a cost per BTU that is in the same range as the pre-tax cost of petroleum fuels. This fact places the question of green-ammonia economics in an encouraging light, even with the inevitable differences in feedstocks, processes, and scales. “Green” does not inherently mean “more costly.”

Many stakeholders believe that the economics of producing ammonia from biogas or biomass are the most promising. Researchers from the Indian Institute of Technology in India and Monash University in Australia published a paper in 2016, “Small-Scale Ammonia Production from Biomass: A Techno-Enviro-Economic Perspective”, that “highlight[s] the techno-economic advantages that result from small-scale ammonia plants based on biomass feedstock.” The start-up company Midwest BioEnergy of Morrison, IL in the U.S. is reportedly building up to four plants that use as feedstock biogas from wastewater treatment plants. Companies such as SynGest and BioNitrogen have focused on using biomass as a feedstock but have so far been unable to achieve business viability.

Many ammonia energy advocates see renewable-electricity-to-ammonia as the ultimate in sustainability. The abundance of renewable electricity is not constrained by environmental limits in the way that biomass production is. However, electricity is a much more highly refined and valuable energy commodity than biomass, and its economics reflect that fact. Hence, this is the method of green ammonia production that might benefit most from a price on carbon emissions.

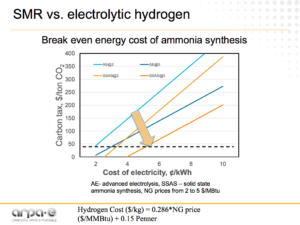

This question has been examined by Grigorii Soloveichik, a Program Director at the Advanced Research Projects Agency-Energy (ARPA-E) program at the U.S. Department of Energy. During his keynote address at the 2016 NH3 Fuel Conference in September, Soloveichik spoke about the relative costs of ammonia produced conventionally from natural gas feedstock, carbon-free ammonia produced via “advanced electrolysis”, and carbon-free ammonia produced via solid state ammonia synthesis (SSAS). He showed a graph that presented four scenarios involving a hypothetical price on carbon emissions.

The first scenario involves advanced electrolysis in an environment where natural gas is priced at $2.00 per million BTUs. (Natural gas prices on the New York Mercantile Exchange have generally been in the $2.50 to $3.00 range over the last year.) In this scenario, carbon-free ammonia is essentially unable to compete. Even with an electricity price of $0.02 per kWh, the price of carbon emissions would need to be $50 per ton for green ammonia to achieve production cost parity with brown ammonia. Although the World Bank report cites a handful of jurisdictions whose carbon price is above the $50 per ton threshold, the vast majority have prices under $25.

The second scenario is the same as the first except with the price of natural gas set at $5.00 per million BTUs. The third scenario mimics the first scenario except with the economics of SSAS substituted for those of advanced electrolysis. The fourth scenario mimics the second in the same way (i.e., SSAS competes against conventional production with the natural gas price at $5.00 per million BTUs). The indications from all three of these scenarios show promise for green ammonia.

In the second scenario, competitiveness is achieved with a carbon price of $25 per ton when the price of electricity is $0.02 per kWh. In the third and fourth scenarios, a carbon price of $25 per ton allows the green ammonia to compete with electricity prices of $0.03 and $0.04, respectively.

These electricity prices sound low when compared with, for example, the $0.125 per kWh that is the average residential price for electricity in the U.S. They sound less low when the benchmark is the average industrial price in the West South Central region of the U.S. – which is $0.053 per kWh, or the industrial price in Washington State – which is $0.046.

For now the final word on this comes from the U.K. start-up Eneus Energy. Eneus “integrates existing, proven industrial technologies to take surplus, spill or constrained renewable electricity in order to produce ‘green’ ammonia,” according to the company’s Web site. It can be presumed that “surplus, spill, or constrained” electricity – such as that produced by hydropower generators during seasons of abundant rainfall or wind generators at night – can be had for prices below the benchmarks cited above.

In an email exchange, the company’s Chief Executive, Chris Bronsdon, confirmed that Eneus is not staking its fortunes on the widespread, near-term adoption of carbon-pricing. “Our commercial approach is built on producing renewable ammonia that competes in the existing market, and that will also benefit from upsides where its zero carbon provenance is recognised, or where our approach brings additional benefits that can be valorized in a range of markets,” Bronsdon wrote. He said that while Eneus would certainly welcome carbon pricing, it may not lead to an immediate surge in new investment. He cautions, “It could take some time before investors were comfortable that carbon adjusted prices were not a temporary (and potentially reversible) regulatory issue.”