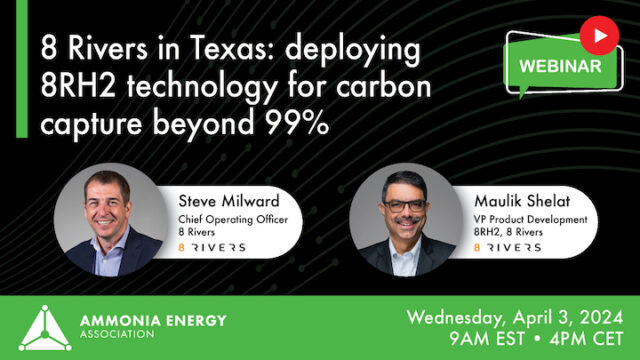

Webinar

8 Rivers in Texas: deploying 8RH2 technology for carbon capture beyond 99%

Meet 8 Rivers to learn about their proprietary 8RH2 technology, which allows for CO2 "capture" in excess of 99% from gas-based ammonia production, and their project based on 8RH2, Cormorant Clean Energy, which will produce 880,000 metric tons of “ultra low carbon” ammonia each year from 2027 in Port Arthur, Texas.