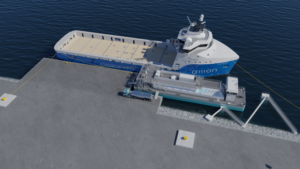

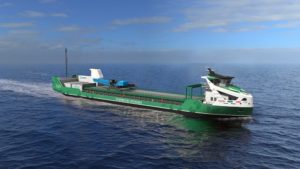

Fortescue Future Industries, Maritime and Port Authority Singapore and a host of supporting organisations announced a world-first marine trial in Singapore harbor last week. The vessel sailed on ammonia and diesel dual-fuel in harbor waters, after being loaded with liquid ammonia fuel at Vopak’s Banyan Terminal on Jurong Island. Two years of vessel development and months of safety and training exercises led up to the trial. MPA and Fortescue report that post-combustion NOx levels from the vessel met local air quality standards for Singapore, with further emissions treatment measures to be applied.